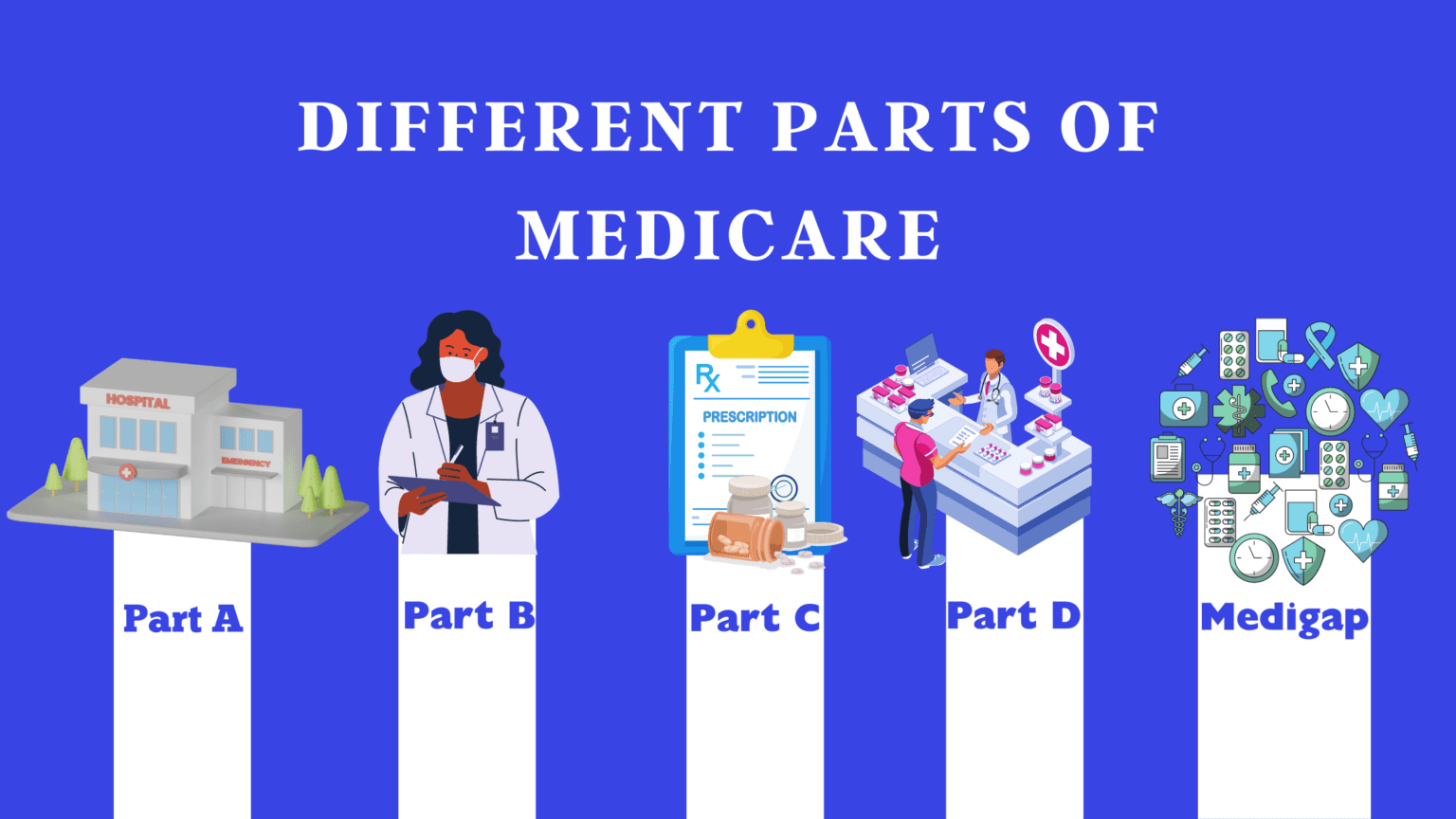

Navigating the complex world of healthcare can be a daunting task, especially when it comes to understanding the various parts of Medicare. Whether you are approaching the age of eligibility or assisting a loved one with their healthcare decisions, having a clear understanding of Medicare is essential. In this brief guide, we will break down the different parts of Medicare, helping you make informed choices and ensure you receive the healthcare coverage you need.

Part A: Hospital Insurance

Medicare Part A, also known as Hospital Insurance, covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home health services. This part of Medicare is generally available at no cost to individuals who have paid Medicare taxes for a certain period of time. It is important to understand the coverage limitations, such as the deductible and any potential coinsurance or copayments.

Part B: Medical Insurance

Medicare Part B, or Medical Insurance, covers doctor visits, outpatient care, preventive services, and durable medical equipment. Unlike Part A, Part B requires a monthly premium payment. It is crucial to enroll in Part B during your Initial Enrollment Period to avoid late enrollment penalties. Understanding the coverage, including the deductible and coinsurance, will help you make informed decisions about your healthcare needs.

Part C: Medicare Advantage Plans

Medicare Part C, also known as Medicare Advantage, is an alternative to Original Medicare (Part A and Part B) offered by private insurance companies. These plans provide all the benefits of Part A and Part B, and often include additional coverage such as prescription drugs, dental, and vision services. Medicare Advantage plans usually have their own networks of providers, and costs and coverage may vary. It is important to carefully review the details of each plan before making a decision.

Part D: Prescription Drug Coverage

Medicare Part D is prescription drug coverage provided by private insurance companies. This coverage helps pay for the cost of prescription medications, which can be a significant expense for many individuals. It is essential to review and compare different Part D plans, as they can vary in terms of the medications covered, costs, and pharmacy networks. Understanding the “donut hole” coverage gap and the annual enrollment period will help you make the most of your prescription drug coverage.

Supplemental Insurance: Medigap

Medigap, also known as Medicare Supplement Insurance, is also offered by private insurance companies to help fill the gaps in coverage left by Original Medicare. These plans can help pay for out-of-pocket costs such as deductibles, copayments, and coinsurance. Medigap plans are standardized and labeled with letters (Plan A, Plan B, etc.), offering various coverage options. It is important to compare plans and understand the benefits they provide before choosing a Medigap policy.

:

Understanding the different parts of Medicare is crucial for making informed healthcare decisions. Whether you opt for Original Medicare (Part A and Part B) or choose a Medicare Advantage plan, knowing the coverage, costs, and enrollment periods will empower you to make the right choices. Additionally, considering supplemental or Medigap insurance along with a prescription drug plan (Part D) is a different way to provide personal financial protection and peace of mind.

Remember, Medicare is a complex system, and individual needs may vary. Seeking guidance from trusted resources, such as a Medicare certified and licensed insurance agent, can help you navigate through the process and ensure you receive the healthcare coverage you deserve. With this introductory guide, you now have start on what you need to know to make informed decisions and optimize your Medicare benefits.

Have Medicare questions? Please schedule a call here.